Grow Your Business with Proven Digital Marketing Solutions

Trusted Partners & Associations

Our Services

WEB DESIGN & DEVELOPMENT

We craft cutting-edge web design and landing page solutions tailored to your business. Our expertise includes visual communication, user-friendly interfaces, content strategy, workflow automation, and seamless shopping cart systems.

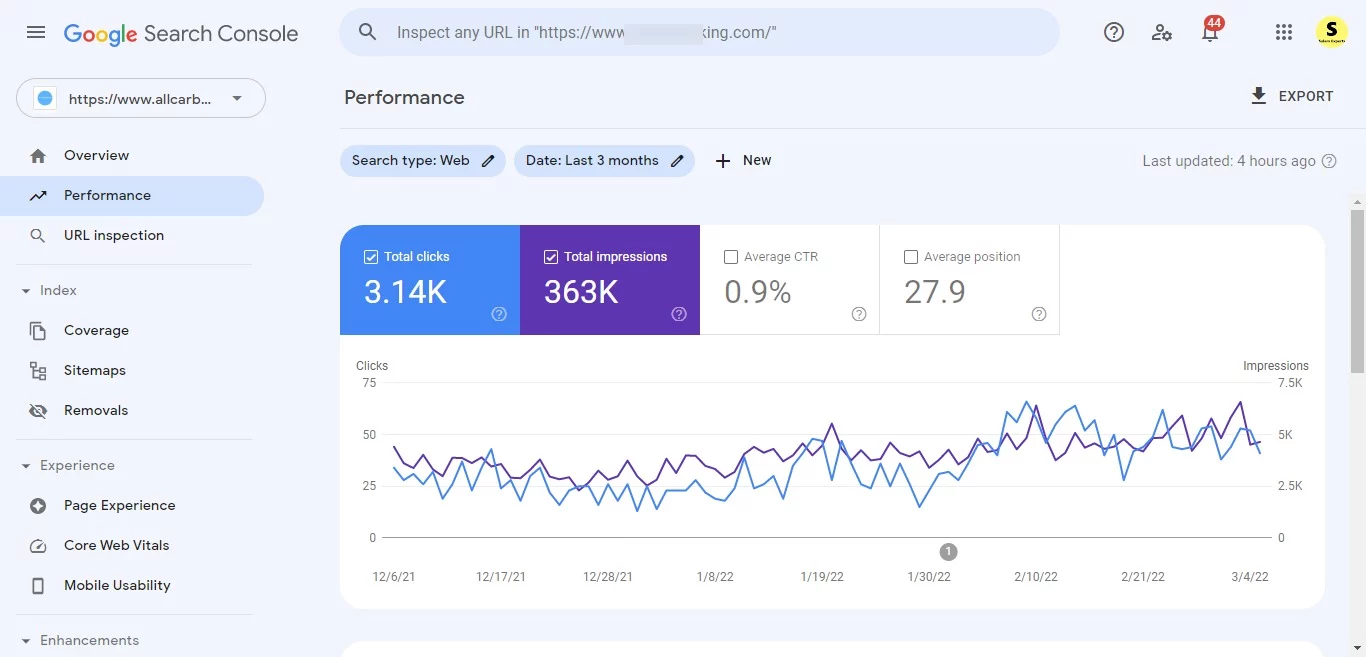

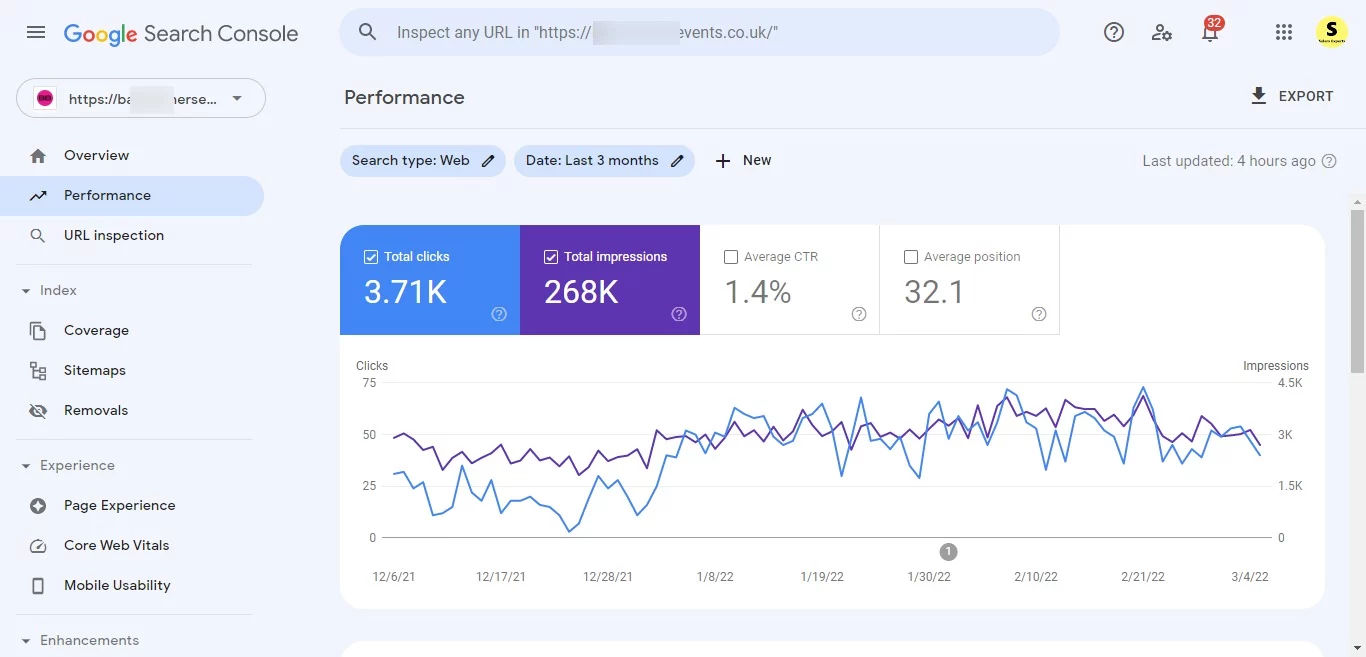

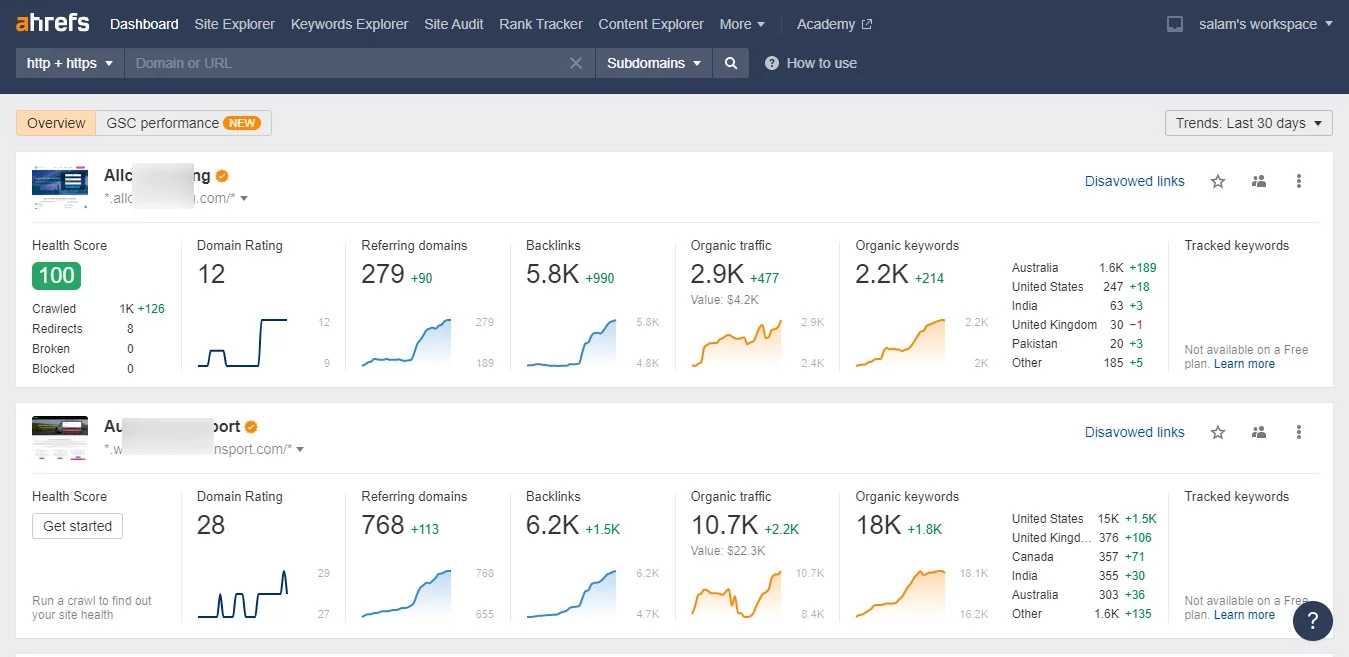

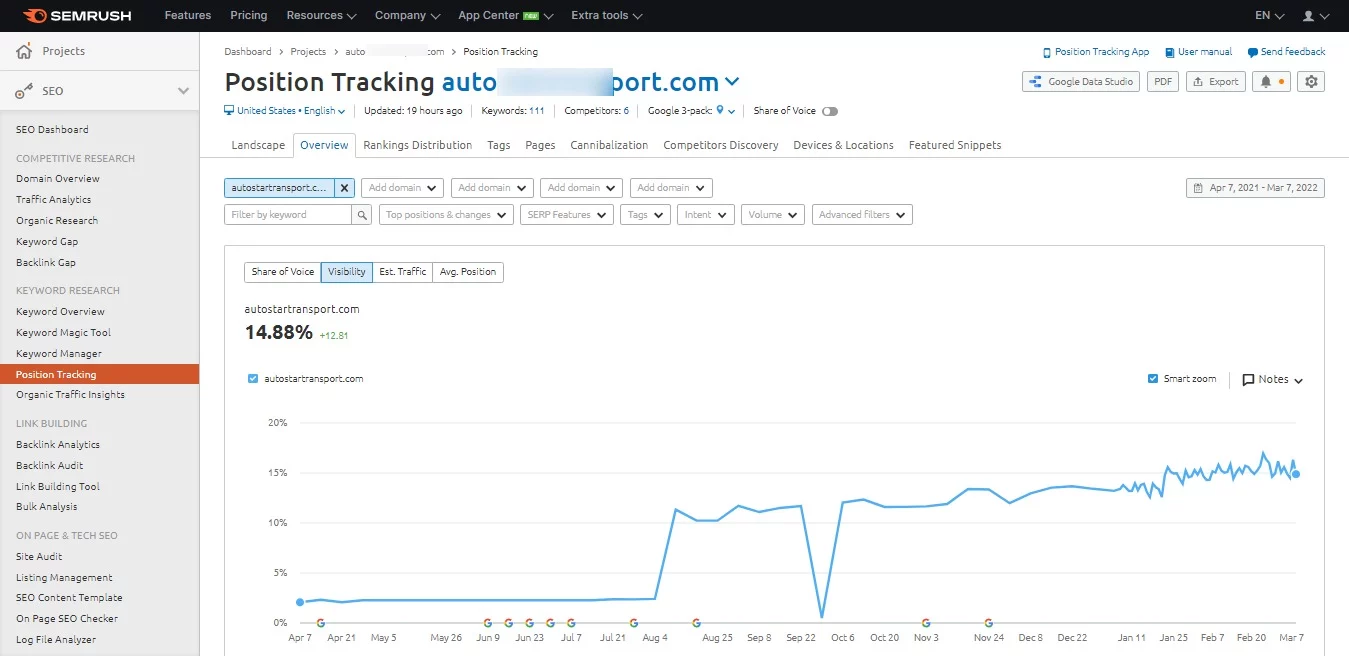

Digital Marketing

Last year, we generated over 10,000 qualified leads for businesses across the USA, UK, and Europe. Our certified SEO, PPC, and SMM specialists deliver measurable results to help your business thrive.

Consultancy

From strategic planning for digital marketing and SEO to creating winning SEM campaigns, our consultants help you boost traffic, generate leads, and drive sales. Let’s discuss how we can help.

We Help Businesses To:

- Increase Targeted Traffic

- Generate Qualified Leads

- Improve Brand Visibility

- Drive More Sales

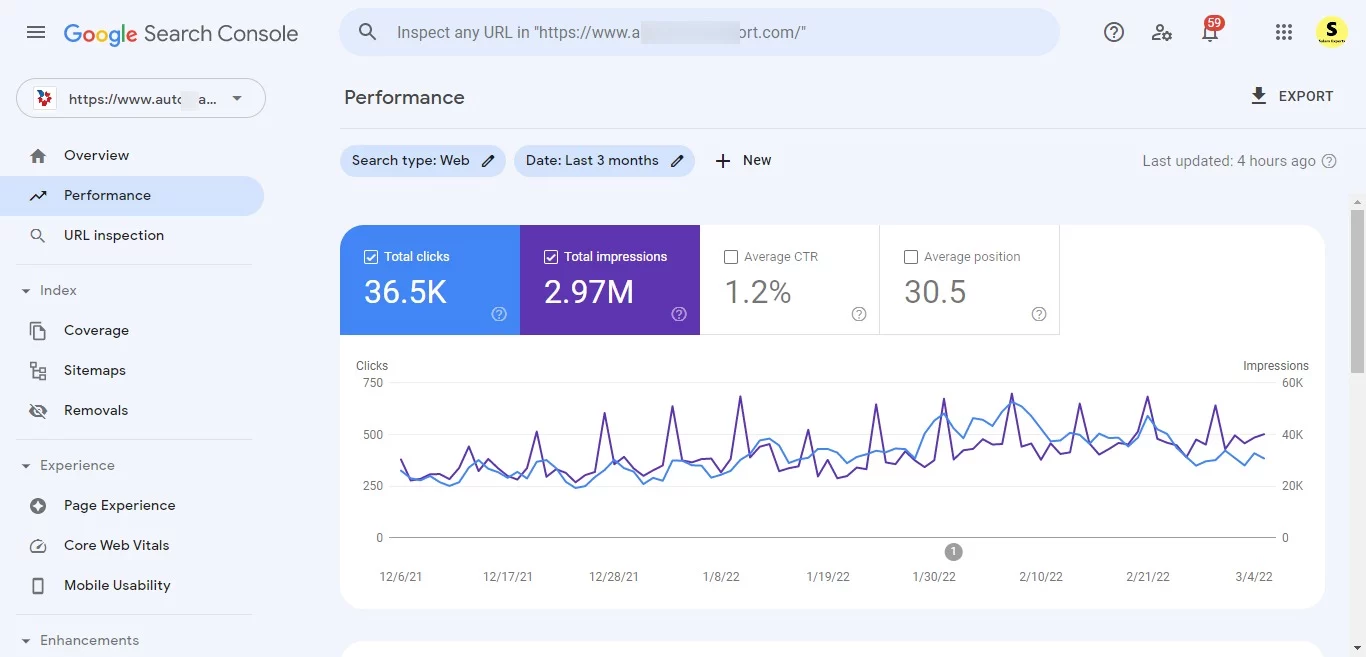

Proven Results for Our Clients

3.5x

Increase in SEO Traffic

74%

Boost in sales-qualified leads

100%

Growth in PPC revenue

35%

Increase in conversion rates

About Us

At Salam Experts, we specialize in delivering unbeatable digital marketing solutions tailored to your needs. With unique expertise and a proven track record, we design campaigns to elevate your business.

Whether it’s SEO-driven web design, search engine marketing, professional copywriting, or social media campaigns, we’re dedicated to taking your business to the next level.

We offer full-scale web design, development, and maintenance services alongside SEO, SEM, PPC, and SMM solutions for B2C and eCommerce clients.

Industries We Serve

We’ve excelled in diverse industries, including:

Banking & Finance

Logistics

Education

Transportation

Travel

Game

e-Commerce

Construction

Manufacturing

Restaurants

Healthcare

Social Network

Need Help Growing Your Business Online?

Your Long-Term Partner for Web Solutions, SEO, and Digital Marketing

At Salam Experts, we handle your website and digital marketing needs with precision and care. Our focus is on generating high-quality leads and boosting sales by optimizing your site for top search rankings.

Enjoy a steady stream of free, high-quality leads from Google, Bing, and other search engines—without overspending on ads. Ready to grow?